Understanding Tax Rates in Australia: A Comprehensive Guide to Calculation

BlogTable of Contents

- Australian Income Tax Rates 2014 • Australia First Party

- Australian Tax Brackets in 2024 - Tax Basics for Beginners - YouTube

- Australia’s tax rates: Top earners shoulder more of the tax burden

- Household Income Australia Tax - Spot Walls

- tax brackets australia - beyondearheadphonescenter

- Five problems with the Australian tax system – and the changes to Stage ...

- Tax Brackets in Australia for 2022

- Stage three tax: How much tax Australia’s high earners are paying

- Tax Brackets 2024 Australia Ato - Willa Julianne

- Tax brackets in Australia | Sleek

As a taxpayer in Australia, it's essential to have a clear understanding of the tax rates and how to calculate your tax liability. With the help of Odin Tax, a leading tax consulting firm, we'll break down the tax rates in Australia and provide a step-by-step guide on how to calculate your tax. In this article, we'll delve into the world of tax rates, exploring the different types, tax brackets, and calculation methods to ensure you're well-equipped to manage your tax obligations.

Tax Rates in Australia

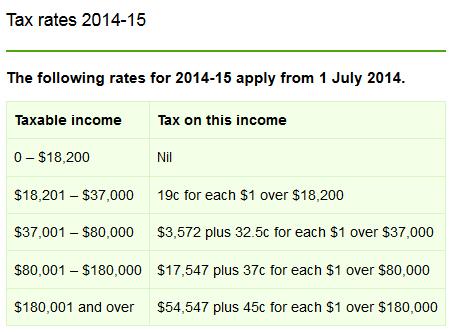

The Australian tax system is progressive, meaning that the tax rate increases as the taxable income increases. The tax rates in Australia are as follows:

- 0 - $18,201: 0% (tax-free threshold)

- $18,201 - $37,000: 19%

- $37,001 - $90,000: 32.5%

- $90,001 - $180,000: 37%

- $180,001 and above: 45%

How to Calculate Tax in Australia

To calculate your tax liability, you'll need to follow these steps:

- Determine your taxable income: This includes your gross income from all sources, such as employment, investments, and business income, minus any deductions and exemptions.

- Apply the tax rates: Use the tax rates table above to determine the tax rate that applies to your taxable income.

- Calculate your tax liability: Multiply your taxable income by the applicable tax rate.

- Claim any tax offsets: You may be eligible for tax offsets, such as the low-income tax offset or the senior Australian tax offset.

- Pay any additional taxes or receive a refund: If you've paid too much tax throughout the year, you may be eligible for a refund. Conversely, if you haven't paid enough tax, you'll need to pay the difference.

Tax Calculation Example

Let's say you have a taxable income of $60,000. Using the tax rates table above, you would pay:

- 0% on the first $18,201 = $0

- 19% on the next $18,799 ($37,000 - $18,201) = $3,571.81

- 32.5% on the next $23,000 ($60,000 - $37,000) = $7,475

Your total tax liability would be $11,046.81 ($0 + $3,571.81 + $7,475).

Calculating tax in Australia can seem complex, but by following these steps and understanding the tax rates, you can ensure you're meeting your tax obligations. Odin Tax is here to help you navigate the tax system and provide expert advice on tax planning and compliance. Contact us today to learn more about how we can assist you with your tax needs.

Remember, it's essential to stay up-to-date with changes to tax rates and regulations to avoid any potential penalties or fines. By being proactive and seeking professional advice, you can minimize your tax liability and maximize your refund.